Vanda is a global independent research company that provides tactical macro and strategic investment analysis to institutional investors.

Speak to our teamWe combine positioning, expectation and mass-market psychology to deliver outstanding macro insight.

Markets are largely efficient in the short-term. We focus on where expectations are, and where it’s most likely that future events will diverge from the collective forecast.

All things being equal, uncrowded trades are more profitable than crowded ones. We spend a lot of time analyzing where the crowds are, and trying to avoid them.

What’s the difference between long-term Treasury yields and the relative performance of cyclical vs. defensive equities? Not much. Our cross-asset focus lets us spot dislocations across asset classes.

Our investment horizon spans 3-6 months. Why? Because that’s the average duration of individual risk cycles in the post-crisis era.

Of course, markets can stay crowded longer than investors can stay solvent. Our analysis incorporates the catalysts most likely to force price discovery.

US macro data affect European sovereign yields. ECB actions impact Japanese equities. And Chinese policy drives EM currencies. We monitor it all.

The CIO Risk Report

Vanda’s flagship weekly research publication, with a high level summary of Vanda’s broad outlook for global markets and trade recommendations.

Positioning Update

Data focused updates on how positioning data has changed week to week or highlighting an emerging positioning trend.

FICC TACTICAL STRATEGY

A weekly deep dive into key macro, geopolitical and positioning-related themes driving global FICC markets with the aim of generating and monitoring Vanda’s high conviction tactical trades.

TACTICAL ASSET ALLOCATION MONTHLY

This monthly publication provides a round up of Vanda's market calls and trades in a traditional asset allocation format. Aimed at providing asset allocators with a 3-6 month outlook in order to help clients tilt portfolio allocations and dial up or down risk on their core positions.

GLOBAL EQUITY TACTICAL STRATEGY

This weekly research publication is focused on the latest global equity regional and sectoral themes. The piece will be grounded by Vanda's tactical framework - leaning on positioning and alternative data - to help guide our clients on how to analyse and position themselves in global equity markets.

RISK UPDATES

Concise and to-the-point updates on developments that are moving markets right now, helping clients identify the signal amidst the daily noise.

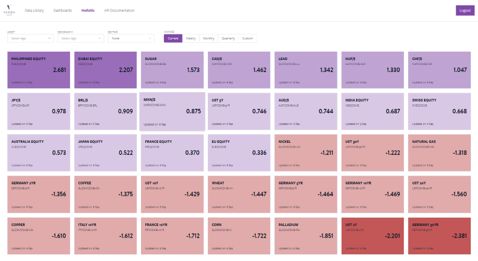

Data Products

Vanda has created two online proprietary data platforms, VandaTrack & VandaXasset, which provide clients with positioning and flow metrics across retail and institutional investors as well as global assets and access to over 1,100 of Vanda's proprietary data sets.

Risk Calls

We conduct daily, weekly and quarterly risk calls with select clients, providing real time analysis of changing market conditions and tactical trade ideas.

Bespoke Analysis

For clients with specific research requests, we’re here to help. By having a research presence in New York, London and Singapore, Vanda can provide analysis through email and Bloomberg chat when you need it most.

Vanda Research is now opening up access to over 1,100 of the proprietary and curated positioning data sets that underpin Vanda’s tactical macro research. These cross asset positioning and flow data sets are delivered through an API, FTP, AWS and an online platform.

Learn more

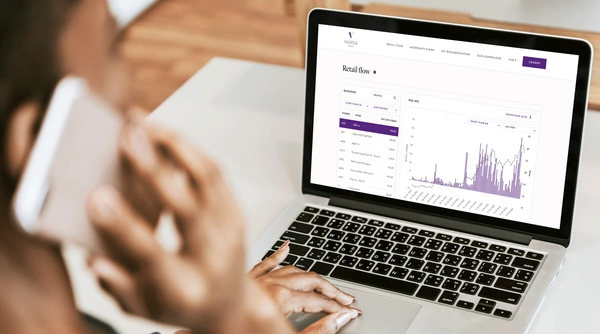

VandaTrack provides daily data on retail investors’ net purchases of US single stocks and ETFs. Check the leaderboard of the most bought and sold securities on a daily basis, access a customizable web-based user interface, or use our API to automate the download of the data.

Learn more

If you are interested in a trial subscription or would like to receive one of our recent reports, please fill in the contact form below.